Zero premium Medicare Advantage plans. Are they really free? How is it possible to get a zero premium Medicare Advantage plan? Someone has to pay for it. What are the hidden costs of a $0 premium Medicare Advantage plan?

Patrick Higney, 66, doesn’t want to give up the freebies that come with his zero premium Medicare Advantage plan: free aspirin and free Band-Aids, a free blood pressure machine and a free ear thermometer.

Nancy Smyth, 68, wants to keep the free gym membership that comes with the zero premium Medicare Advantage policy she bought from Health Net, a private HMO. And John Kizer, 72, hopes his plan will continue to offer free prescription eyeglasses and free hearing aids.

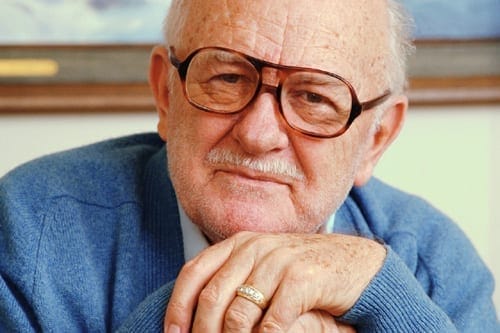

“Everybody’s trying to save their little kingdom,” Kizer, a retired dairy farmer, said last week after receiving a flu shot. The shot was free, of course on a zero premium Medicare Advantage plan.

Seniors in this Sun Belt retirement haven and across the country revel in the free perks that private insurance companies bundle with legally mandated benefits to entice people 65 and older to forgo traditional Medicare and sign up for private zero premium Medicare Advantage policies.

The trouble is, the extra benefits are not exactly free; they are subsidized by the government. And some of the plans pass their costs on to seniors, who pay higher co-pays and additional fees to get care.

Ahh, there really is no free lunch, even with zero premium Medicare Advantage plans. But then, you already knew that.

President Obama has proposed cutting more than $100 billion in subsidies over 10 years, a contentious component of health-care reform that will be fought in earnest as the bills move through Congress.

And just like squeezing a balloon, reduced taxpayer funding will cause an increase in premiums (for those that are not zero premium Medicare advantage plans) and an increase in the amount you pay for services (higher copay’s, higher coinsurance, higher out of pocket).

“This (Medicare Advantage plans) is a program that more than 11 million seniors currently rely on, and seniors have expressed very high satisfaction with this program and want to be able to keep the coverage,” said AHIP communications director Robert Zirkelbach. “Seniors are going to be shocked when they find out what these cuts are going to mean.”

Shocked is an under-statement.

The time to act is NOW, not after the horse is out of the barn.

Roughly 1 in 4 seniors have MA plans, including the popular zero premium Medicare Advantage plans. In some area’s Advantage plans have a 32% market share.

In Tucson, many seniors have zero premium Medicare Advantage policies, while others pay relatively small monthly fees to get added benefits such as dental care. But many pay fees for each doctor’s visit, on top of co-payments as high as 20 percent of costs.

Many seniors said they were drawn to the zero premium Medicare Advantage plans because they were relatively healthy and visit hospitals rarely, and because their premiums would be substantially higher if they bought full-coverage supplements to traditional Medicare.

“The appeal is cost, obviously,” said Norman Powers, 72, a retired electrical engineer, who signed up with his wife, Carole. He said they have not had any costly medical operations — and then knocked on a wooden table. The gym membership that Health Net gave away has been a plus, he said.

“We do the full workout, treadmill, the works,” Powers boasted. “And it’s all free. We were paying $600 a year for our gym membership before.”

If taxpayer funding for MA plans, and especially the zero premium Medicare Advantage plans is cut, expect your out of pocket costs to skyrocket.

If you have a zero premium Medicare Advantage plan, tell your Congress critter to keep their mitts off your plan.